We’re obsessed with Financial Services (FS) at the moment. It’s a sector rife with change and opportunity. Today we’re discussing what seems to be lacking and despite efforts in innovation, why FS still seems to be missing the point because of an incomplete understanding of the customer journey.

Visa, Barclays, NatWest and Santander amongst others have all launched fintech incubators or some sort of start-up fund over the last few years. On the face of it, it’s a smart move. However integrating this innovation into normal business isn’t happening in any kind of meaningful way.

To us, the real problem is changing consumer behaviour, that has dramatically altered the customer journey. Effective communications and engagements happen across the customer journey in the modern world, but the sector as a whole seems to not have noticed. Something needs to change, fast. The World Economic Forums’ ‘Future of Financial Services’ report highlighted an unprecedented level of change for the industry. You can read the key points here.

I’m sure it’s been said a lot but for big brands, they perceive change as being difficult. For every discussion about innovation there’ll be a discussion about how difficult it is to get anything done within a big brand. It’s the kind of barriers as marketers we’re familiar with. But, it strikes us that aligning around the customer journey is definitely a place to start. Once you understand your customers and their touch points you can start to think about how you interact with them. Surely this then helps to evaluate the innovations you bring into your normal business? Interesting parallels are drawn with digital at large – once upon a time it was thought of as just another media channel, then things started to change and now digital isn’t just about websites and banner ads. It’s something that should be integrated across your whole brand ecosystem. The reality is however, that in most cases it’s not.

So why get involved? There are risky investments in the bigger picture and innovation isn’t being brought into the normal business areas. Yet.

I’d argue that what actually makes these businesses interesting is a fundamental difference in the way that they build their products and services. In an ideal world, what I would like to see is more of a culture transfer based around an approach that really puts the customer at the centre of brand. Look at the collaborative economy, peer to peer businesses have been popping up all over the place in FS with some very successful propositions. Why? Because they are facilitating something that that people want to do in a way they want to do. The “I have, you need” philosophy.

I should qualify this article by saying that whilst it does talk about large institutions I am referencing the whole sector. When you come down a rung or two in times of size and scale, the problems seems to be multiplied. Mid-size organisations don’t have a fintech incubator in Tech city. So what the hell do they do. How can they compete? Simple – understand your customers, understand your landscape and competition and think about how you can slowly begin change.

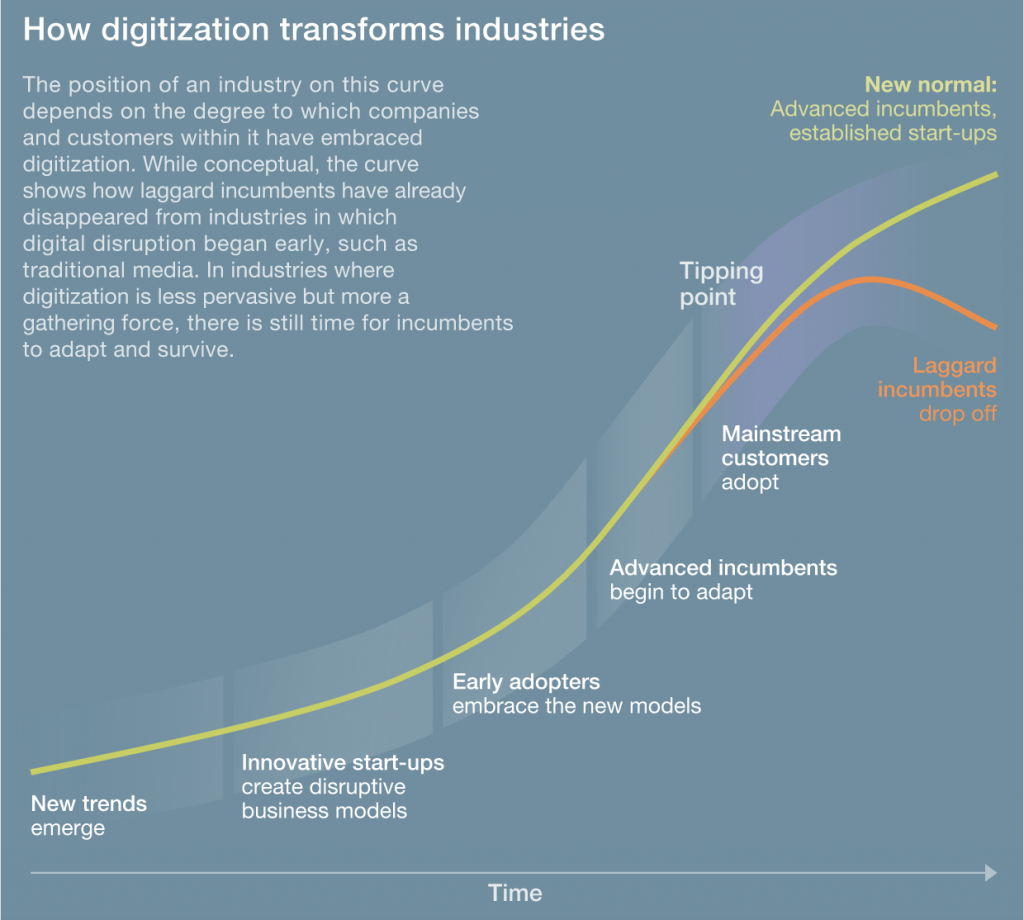

Have a look at this chart, where do you fit?

How digitization transforms industries McKinsey.com

Taking all of this in context, it still seems to me that no one incumbent has got this cracked. Change has happened and it’s just a matter of time, especially if you’re doing nothing, that things start to go backwards. Let’s end on a positive however – if you can’t innovate your products and services you can definitely innovate your customer contacts. You can become integrated, you can do something about the experience your customers have around your existing products and services.

So I guess the reason why the big institutions are getting involved is to hedge their bets. Hopefully one day, being able to integrate the innovation-led customer-first approach into their core business or when the innovative tech becomes the new norm, they’ll have a slice of the pie.

If you want to give your customer an outstanding experience every step of the way, why not get in touch, we can discuss how we can do it together over a nice cup of tea. Contact us through our form, or call us on 020 3771 2461.